With Power Generation Vulnerable to Climate Impacts, Investors Must Understand Physical Risks

This year has been one of extreme weather events. Catastrophic floods disrupted the lives and livelihoods of millions in Europe and Asia. Heatwaves, wildfires and exceptional droughts parched farmers and utilities in North America. Climate change is already intensifying extreme weather events and will continue to affect people and businesses around the world.

The power generation sector is particularly vulnerable to climate change. This critical sector depends on water for fuel and cooling. As a result, the sector is vulnerable to changes like rising temperatures, changing rainfall patterns, soaring water demand and more.

At the same time, there is an increasing demand for investors to disclose climate risks that impact businesses. For example, the European Union’s Sustainable Finance Disclosure Regulation requires financial sector firms to disclose how they integrate sustainability-related risks in their investment decision-making. Additionally, more than 1,500 companies and financial organizations support the Task Force on Climate-related Financial Disclosure (TCFD) recommendations to corporations on assessing and disclosing their climate risks. Without this information, investors cannot make informed decisions that protect both their investments and the climate at large. However, it is difficult to assess and disclose physical climate risks without data about climate risks and power plant operations.

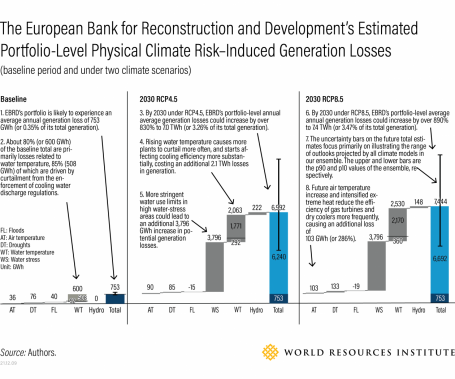

WRI released a new method to quantify physical climate risks for power generation projects at the portfolio level. This method aims to help global investors and utility owners incorporate climate risks into their portfolio assessments. In a pilot test with the European Bank for Reconstruction and Development (EBRD), WRI found that the bank could expect the thermal and hydro power generation assets in its portfolio to experience a 7 terawatt-hour (TWh), or 3.3%, loss in annual generation by 2030 with just moderate climate change (1.8 degree Celsius warming by the end of the century). This scenario could apply to other investors as well, as loss is primarily driven by rising water temperatures and intensified water stress.

Physical Risks from Water Temperature are Often Overlooked

Water temperature is largely overlooked in existing climate disclosure guidelines. However, sustained rising temperatures and intensified heatwaves are likely to occur in many places in the future, which will change water temperature norms globally. The temperatures of the water that utilities use for cooling affect power generation efficiencies and their ability to comply with local environmental regulations.

Thermal power plants rely on water to cool steam in the generators, which converts water vapor back to its liquid form. As a result, higher cooling water temperature generally makes the generation processes less efficient. Additionally, power plants discharge water during the generation process. Higher temperatures can make this wastewater hotter, which could force plants to shut down during hot days if they fail to keep their discharge temperature below local regulatory thresholds.

In EBRD’s case, water temperature accounts for over 80% of the physical climate risk-related baseline generation losses for its thermal and hydro portfolio. This could cost more than 2.6 TWh, or 1.2%, of the maximum possible generation of the entire portfolio every year by 2030 under moderate climate change. Disclosure frameworks that provide guidance for measuring and assessing climate risks, such as TCFD, should expand to provide a more comprehensive coverage of physical hazard metrics like water temperature.

Climate Impact on Hydropower is a Mixed Bag

While physical climate risks are expected to increase at the portfolio level, not all power plants will be affected in the same ways.

EBRD’s current hydro portfolio is likely to see a reduction in overall annual generation. Hydro plants receive water from their upstream watersheds. In most of the watersheds upstream of power plants in EBRD’s portfolio, precipitation is expected to decrease and water consumption is expected to increase, leaving less water available for generation. This could lead to an estimated 222 gigawatt-hour (GWh) reduction in annual average generation by 2030 for the whole portfolio under moderate climate change conditions. However, certain hydro plants could potentially gain generation additions if their upstream watersheds become wetter due to a changing climate.

Rising air temperatures also negatively affect water availability in most cases, as higher temperatures typically lead to more evaporation and thus reduced water supply. However, for hydro plants in watersheds where there are glaciers, temperature increases could contribute to more glacier melt, which would increase water supply and potentially increase generation in the short term.

Climate change also alters global rainfall patterns, leaving some areas with less rain and others with more. For instance, 14 of the 56 hydro plants in EBRD’s portfolio could expect a surplus in annual generation as a result of increased rainfall in their upstream watersheds.

Because there is so much variability on climate risks from plant to plant, assessing climate portfolios as a whole may not tell the whole story. For lenders that are more immediately concerned with limiting downside risks like a nonperforming loan, translating portfolio level generation loss analysis to financial risks must be done carefully and account for results at each plant.

Disclosing Risk is Critical and Requires More Guidance and Resources

Assessing and disclosing physical climate risks on assets and portfolios is critical. But assessment with high granularity is still challenging, largely because data of both climate projections and actual power plant operations are limited.

Though collecting and disclosing the right data is the hardest part in the assessment process, many actors can help improve it. Global climate and hydrology data developers should continue to improve the coverage comparability and granularity of climate hazard data. Utility companies also need to disclose utility-level power generation and vulnerability data, which can significantly improve the quality of physical climate risk assessments.

Additionally, physical climate risk assessment methods and tools should be designed in a way that allows for customization and assessment at the asset level, with transparent methodologies. The ability to incorporate asset-specific data and adjust disruption thresholds are key requirements in conducting more accurate physical climate risk assessments. Investors need to clearly understand the assumptions and limitations in the assessments to be able to make informed investment decisions that will lead the world toward a climate-resilient future.